I had the pleasure of hearing

Avinash Kaushik, Google's analytics evangelist, speak when he came to our CS377W class at Stanford this quarter (the "

Stanford Facebook class"). He's an amazing speaker, really breathing life and purpose into the too-often dry topic of web analytics.

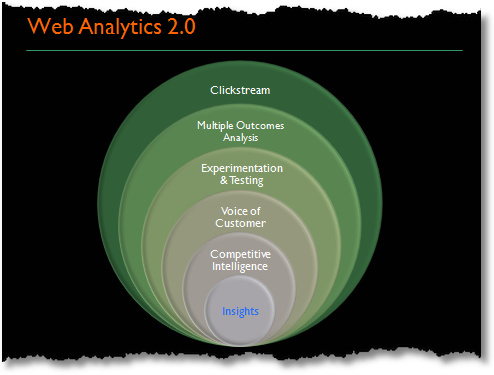

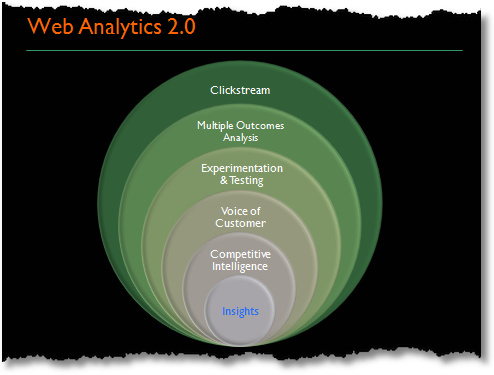

He's promoting a new way of looking at web analytics, what he calls "Web Analytics 2.0". Avinash'es central message is that analytics cannot stand alone as a decision driver in organizations; rather analytics need to be considered in the context of additional data (from customers, competitors, and other internal sources) in order to drive rational decisions.

Avinash has a brilliant decision framework, consisting of the five decision inputs that should be considered in order to gain insight into customer behavior and drive optimal decisions. He calls this "The Five Pillars" and here's the cliff's notes summary: